US stocks opened lower today after closing near record highs in the previous session. Optimism in the tech sector remains elevated, fuelled by Nvidia’s announcements of updates on upcoming products, including the much-anticipated GB10 superchip. On the macroeconomic front, the US trade deficit widened as expected in November, increasing from $73.6 billion to $78.2 billion. The shift reflects businesses front-loading imports due to uncertainty surrounding potential tariffs under Trump’s incoming administration. In the Eurozone, headline inflation in December rose in line with expectations, climbing from 2.2% YoY to 2.4%, driven by higher energy prices. Core inflation, however, remained steady at 2.7%. Meanwhile, the unemployment rate held at 6.3%, underscoring a relatively stable labour market. Despite the uptick in inflation, forward swaps continue to price in a 25bps rate cut at the ECB’s next meeting in late January.

In currency and bond markets, the dollar index remained strong, trading above the 108 level. The 10-year US Treasury yield surged, testing 4.68%.

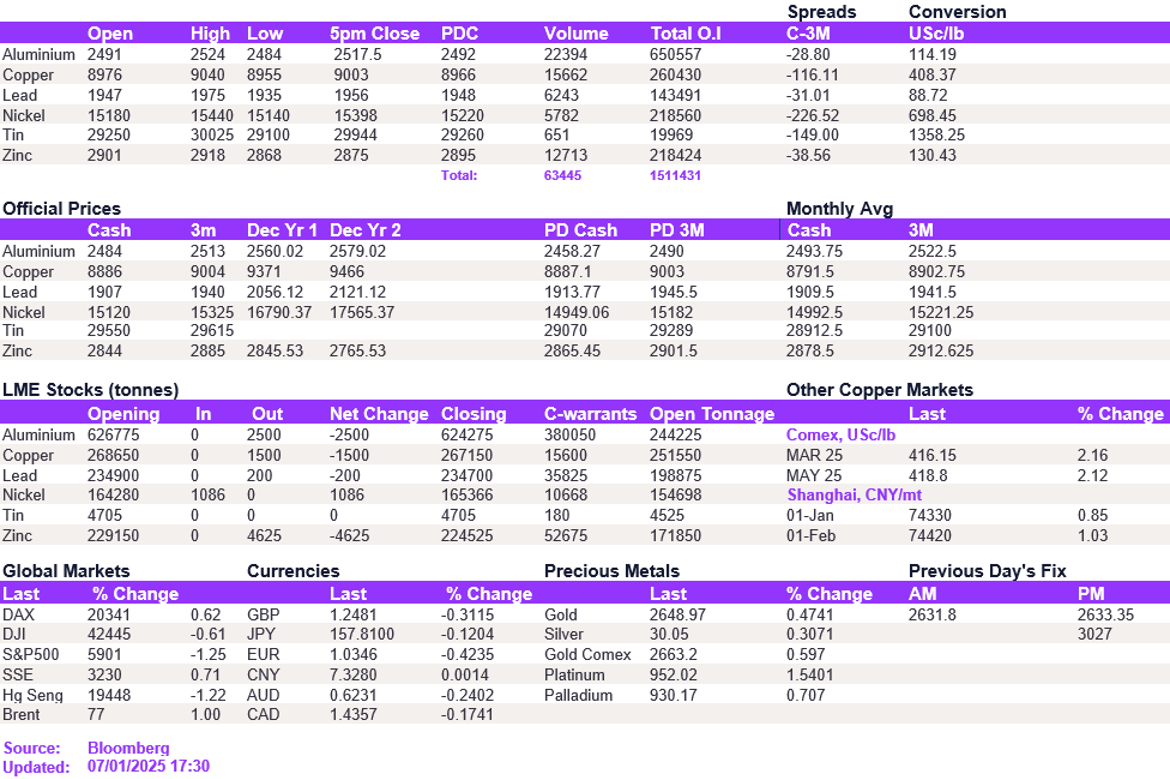

The base metals complex edged higher as prices tested the robust support levels, suggesting a lack of selling pressure and a likely continuation of sideways price moves in the meantime. Aluminium struggled below the $2,500/t mark as it bounced back to $2,517.50/t; copper is testing above the $9,000/t level. Lead and zinc remained relatively subdued, as they held their nerve at $1,956/t and $2,875/t, respectively. Nickel remained above $15,000/t.

Gold rebounded modestly after yesterday’s losses, trading at $2,648/oz, while silver extended its gains, reaching $30.20/oz. Oil prices also climbed today, buoyed by rumours of tighter supply from Russia. WTI rose to $74.30/bbl, and Brent crude increased to $77.10/bbl.

All price data is from 07.01.2025 as of 17:30