US stocks opened lower today, weighed down by weaker-than-expected labour market data. The ADP Employment Change report showed a December increase of just 122k jobs, down from 146k in the previous month and falling short of forecasts. This data heightens the anticipation for Friday’s Nonfarm Payrolls report, which will be critical in shaping expectations for the Federal Reserve’s next policy steps and the broader economic outlook under Trump’s incoming administration. In the currency market, the greenback maintained its strength, with the dollar index climbing to 109.2. Bond markets continued to face pressure, with the US 10-year Treasury yield testing 4.7%. We anticipate that the yield could approach 5% in the coming weeks, driven by rising fiscal concerns and expectations of inflationary policies under Trump’s presidency.

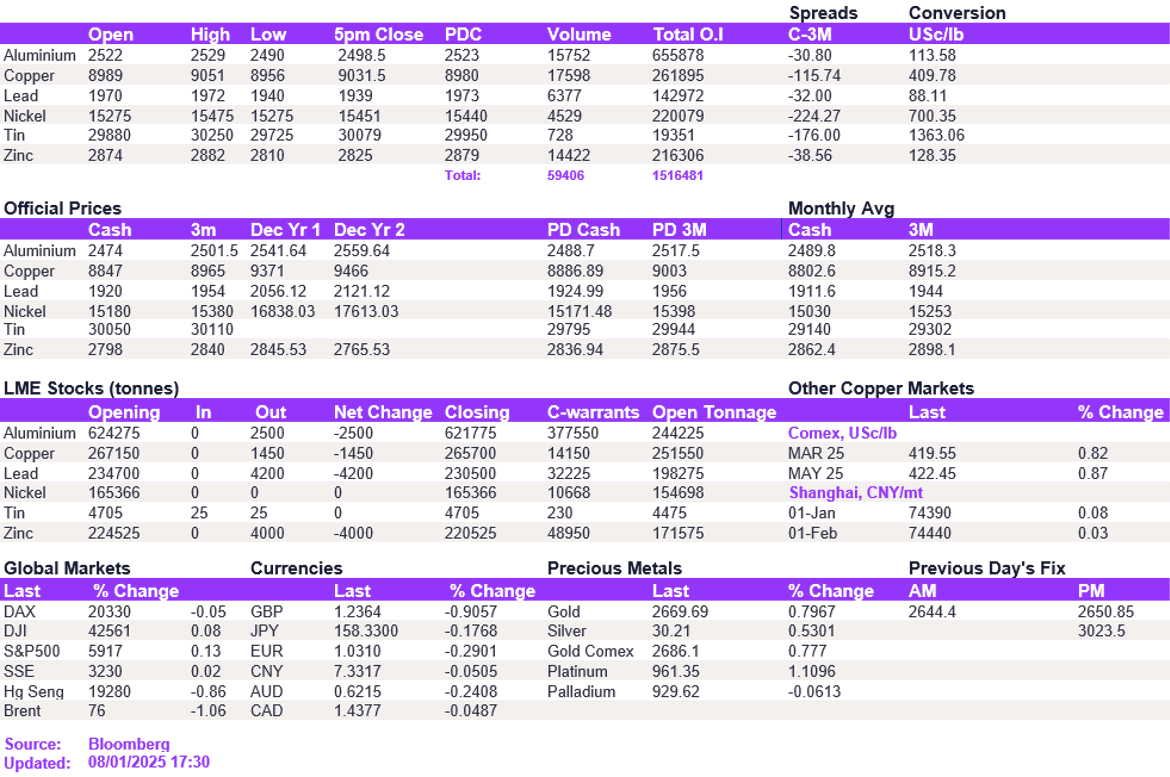

Base metals market performance was mixed today, unaffected by the macroeconomic data and trends. Zinc continued to weaken, falling below the robust support level of $2,867/t to $2,825/t – a September low. Lead was also lower day-on-day as it struggled above the $1,950/t mark, mirroring zinc weakness later on in the day. Aluminium and copper remained rangebound, closing at $2,523/t and $9,031.50/t. Nickel edged higher for the fourth straight day, but as it approaches $15,500/t, the momentum appears to be weakening.

Precious metals saw gains today as investors sought safe-haven assets amid growing market uncertainties. Gold rose to $2,665/oz, while silver remained steady above $30.20/oz. Oil prices stabilised, showing little movement during the session. WTI traded at $74.00/bbl, while Brent crude held at $76.80/bbl.

All price data is from 08.01.2025 as of 17:30