US stocks declined at the open following the release of December retail sales data, which showed weaker-than-expected consumer activity. Retail sales rose by 0.4% MoM, falling short of forecasts and marking a slowdown from the upwardly revised 0.8% recorded in November. In the bond market, the 10-year US Treasury yield continued to edge lower, trading at 4.64% after yesterday’s sharp drop. Meanwhile, the dollar index hovered around the 109 level, reflecting mixed performance across major currency pairs. The dollar weakened against the euro and yen but strengthened against the pound, which came under pressure after UK industrial and manufacturing data signalled deeper-than-expected economic weakness. UK industrial production contracted by 1.8% YoY in November, worsening from the 0.7% YoY decline in October, marking the 14th consecutive month of contraction.

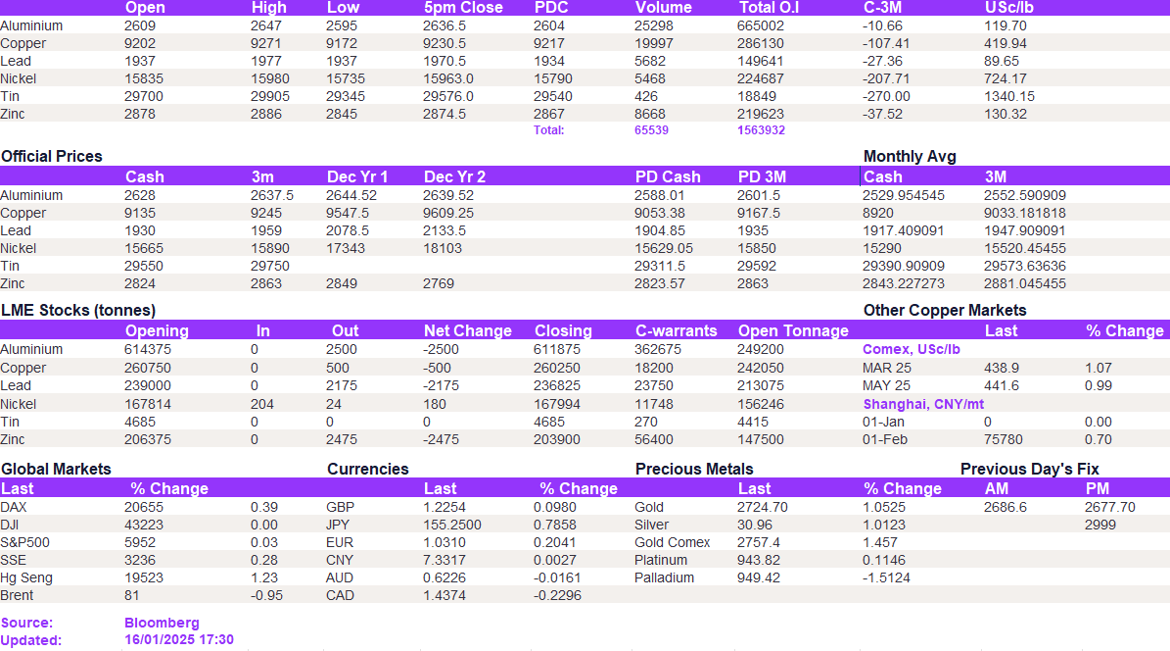

Strong performance in the LME space today. Aluminium broke above 2600/t, reaching 2635.5/t, while copper extended its upward streak, climbing to 9241/t—marking more than a week of trading above the 9000/t level. Lead recovered yesterday’s losses, standing at 1964/t, while zinc edged slightly lower to 2871/t. Tin continued its downward trajectory, posting its sixth consecutive day of declines, dropping to 29345/t.

Gold broke above the 2,700/oz level for the first time since mid-December, trading at 2,719/oz. Over the past two months, gold has struggled to sustain momentum above 2,720/oz, repeatedly retreating toward the 2,600/oz range. If the current rally gathers enough strength this week, this pattern could break, opening the way for a potential move toward 2,800/oz. Silver also edged higher, standing at 30.8/oz. Conversely, oil prices declined steadily throughout the session. WTI fell to 78.8/bbl, while Brent crude slipped to 81.2/bbl.

All price data is from 16.01.2025 as of 17:30