US equities opened higher today, driven by optimism surrounding the business-friendly agenda of newly inaugurated President Trump. The 10-year US Treasury yield edged lower to 4.55%, reflecting increased investor confidence in the potential for pro-growth policies under the new administration. Markets have been reacting to Trump’s proposed policies, which include introduction of tariffs on imports from countries like Mexico and Canada. One of the most significant aspects of Trump’s platform is his plan to evaluate compliance with trade agreements, including the United States-Mexico-Canada Agreement (USMCA) and China’s adherence to the 2020 trade deal. He has also proposed a full review of the US industrial and manufacturing base to determine whether additional tariffs are warranted. These measures are seen as a certainty by markets, fuelling strength in the dollar earlier in the day, before closing the day below the 108 mark. Energy policy has also been a key focus, with Trump pledging to withdraw the US from the Paris Agreement, declare a national energy emergency, and roll back several Biden-era regulations aimed at reducing carbon emissions. His agenda includes opening federal lands and waters to more oil and gas drilling and expediting the approval process for liquefied natural gas export terminals. While the dollar’s strength reflects market confidence in these policies, the lack of immediate clarity on implementation timelines and specific tariff details has contributed to ongoing volatility.

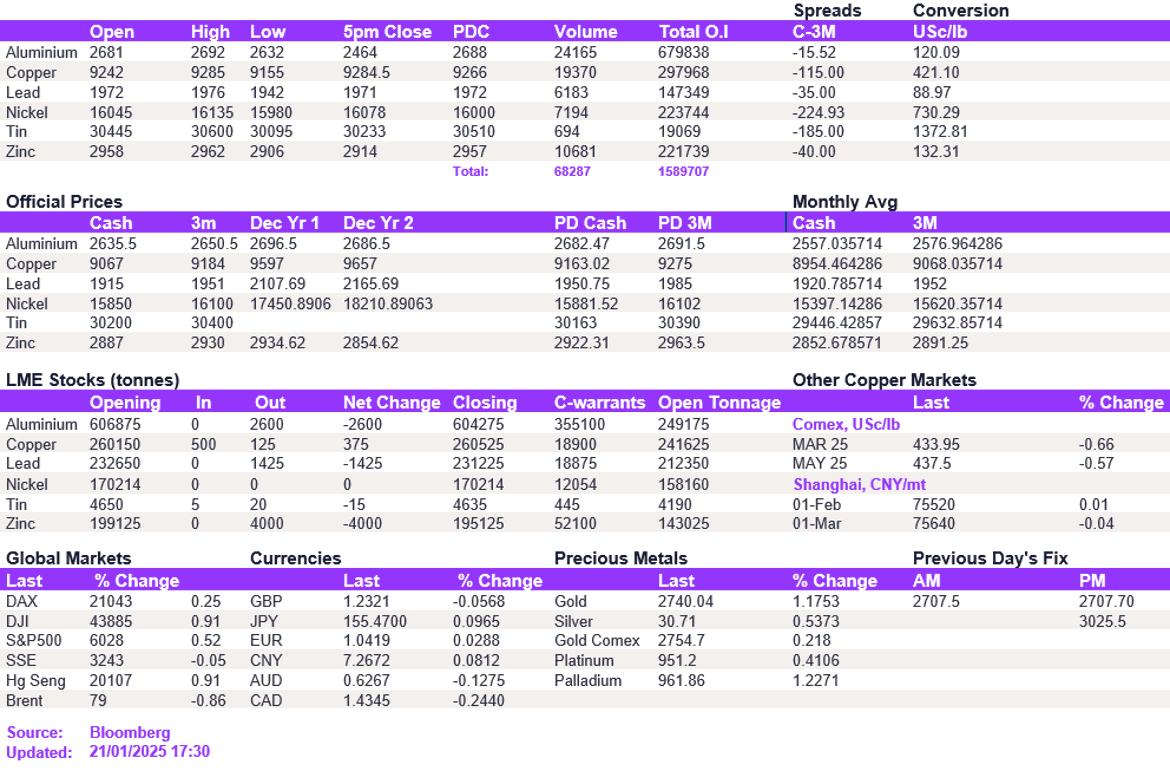

A stronger dollar at the market open weighed on the base metals’ performance; however, it failed to derail their trading trajectory. In particular, copper, while capped by the $9,300/t level, lacked momentum below $9,200/t, continuing a marginal upward trend seen in recent days. The COMEX/LME arb gave back $200 in a single day as COMEX prices weakened along with nearby spreads. In contrast, LME prices remained broadly unchanged, indicating that macroeconomic and political factors, including the current administration under Trump, are not being fully reflected in trades on the exchange. With the Lunar New Year approaching, Chinese participation is waning slightly, but action is expected to return in March and April, as seen per contract activity. We remain moderately bullish on copper in the meantime. Aluminium, on the other hand, began to mean-revert following the rally induced by the sanctioning announcement, correcting back to $2,650/t. Lead and zinc remained unchanged at $1,957/t and $2,915/t, respectively. Nickel remained firmly above the $16,000/t mark.

Precious metals and oil prices reacted to these developments. Gold broke out of its recent range, climbing to 2,740/oz, while silver edged higher to 30.6/oz. Oil prices declined, with WTI trading at 76.4/bbl and Brent at 79.3/bbl, as Trump’s energy policies are expected to boost domestic production.

All price data is from 21.01.2025 as of 17:30