US stock markets opened higher today, boosted by Netflix's record surge and optimism about Trump's policies aimed at boosting AI. The administration also announced plans to impose a 10% tariff on imports starting next month, a lower rate than many had anticipated. However, with the details still uncertain, markets remain cautious, as there is growing speculation that Trump may be using tariffs as a negotiation tool rather than a definitive policy measure. This uncertainty has contributed to increased market volatility. The 10-year US Treasury yield edged higher, trading just below 4.6%, while the dollar index appreciated against major currencies, including the yen. However, despite its strength, the dollar struggled to break above the 108.2 level, reflecting a mixed sentiment.

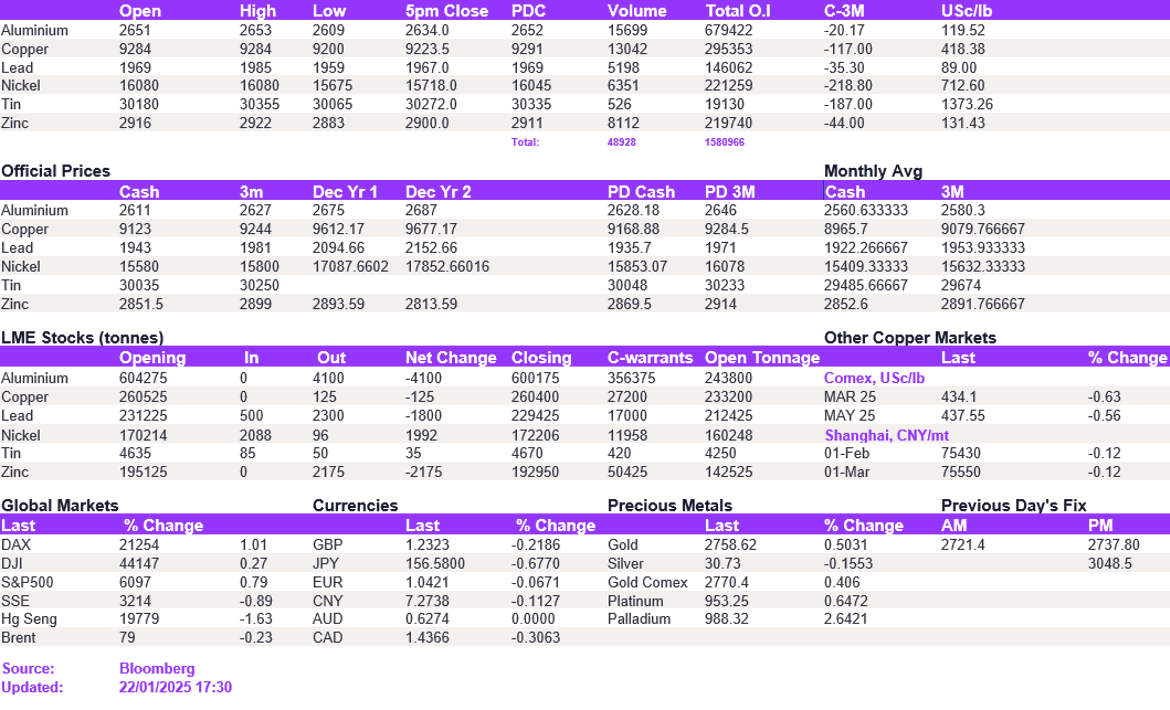

A moderate risk-off sentiment emerged in the base metals market despite Trump’s intention to implement a 10% tariff on Chinese imports in over a week. This figure is already lower than the previously anticipated 60%, and there is little clarity as to whether these tariffs will be enacted on time. Meanwhile, base metals and iron ore did not respond to the news and instead continued to revert to their averages. Aluminium continued to erase recent gains, falling below $2,650/t to $2,635/t. Copper softened but held firmly above the $9,200/t mark. Nickel sold off, as protracted selling pressure to $15,705/t. Lead and zinc held steadily.

Trump’s unpredictability has added fresh momentum to gold, which surged to 2,757.8/oz. Now that gold has broken out of its recent range, the metal appears set to challenge record highs again. However, silver showed a more muted performance, edging slightly lower to 30.7/oz. Oil prices remained largely flat, with WTI trading at 75.6/bbl and Brent crude at 79.1/bbl.

All price data is from 22.01.2025 as of 17:30