US stocks opened lower today as technology stocks faced heavy selling pressure. Investors reacted to the emergence of a low-cost Chinese artificial intelligence model DeepSeek, raising concerns about the competitive dominance of major US tech firms, with Nvidia among the hardest hit. On the macroeconomic front, US new home sales in December rose to 698k, up from an upwardly revised 674k in the previous month, indicating continued resilience in the US housing market despite high mortgage rates. In currency markets, the dollar depreciated against major currencies, particularly the Japanese yen, following a 25bps interest rate hike by the Bank of Japan (BoJ). The USD/JPY pair fell to 154.3, its lowest level since mid-December as expectations grow of more BoJ interest rate hikes this year. The dollar index plunged to 107.3, reflecting broader weakness, while the 10-year US Treasury yield also declined, hovering just above 4.5%. Markets had been anticipating the rollout of Trump's proposed tariffs, but with no announcement yet, fears of immediate inflationary pressures have eased, reducing expectations that the Fed will not need to keep interest rates elevated for longer. In China, Manufacturing PMI for January slipped back into contraction territory, falling from 50.1 to 49.1, while non-manufacturing PMI declined from 52.2 to 50.2, signalling a slowdown in economic activity at the start of the year.

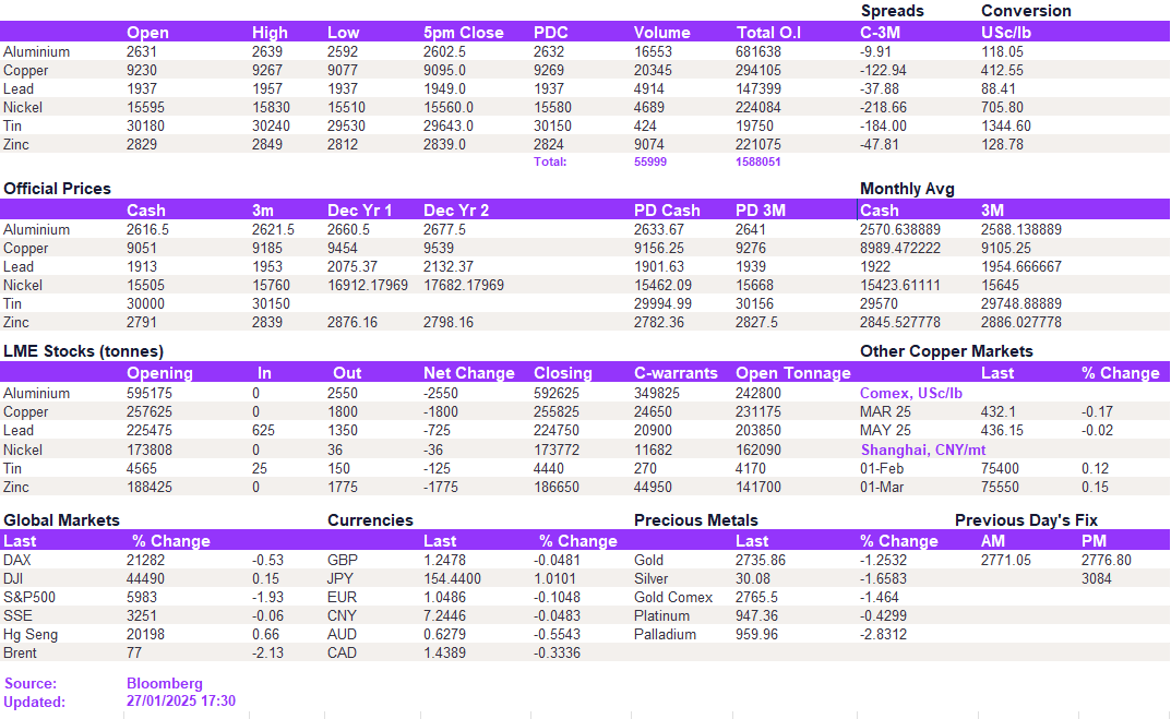

Base metals weakened today despite continued softness in the dollar, further underscoring the disconnect between macroeconomic fundamentals and the broader complex. Instead, given the absence of Chinese market players due to holidays, metals are reverting to their regression means, which have been recorded over the last couple of months. For copper, this level is set at $9,120/t, and the metal dipped slightly below it by the end of the day. Likewise, aluminium is testing the $2,600/t support level, a breach of which could trigger moderate weakness to the mean at $2,573/t. Lead and zinc held their nerve, struggling to find the impetus to break higher. Nickel rejected prices below $15,500/t.

Precious metals struggled to maintain recent momentum. Gold declined, trading below 2,740/oz, failing to break through the record levels it neared at the end of last week. Silver also edged slightly lower, trading at 30.3/oz. Oil prices softened, with WTI at 73.3/bbl and Brent crude at 77.2/bbl, as markets weighed global demand concerns following weaker Chinese data.

All price data is from 27.01.2025 as of 17:30