US stocks opened higher today as investors reacted to the Federal Reserve’s latest policy decision and broader economic data. As widely expected, the Fed kept interest rates unchanged, maintaining the federal funds rate at 4.25%-4.50%. However, attention remains on the central bank's forward guidance, with markets closely watching signals on the timing and scale of potential rate cuts later in the year. In the US, Q4 GDP growth slowed more than expected, rising 2.3% QoQ, down from 3.1% in Q3. While inflation has moderated significantly, markets remain cautious about potential upside risks, particularly from possible inflationary tariffs under the Trump administration, which could drive price pressures higher. The dollar weakened following these developments, with the dollar index falling below 107.8 while the 10yr US Treasury yield remained mostly unchanged hovering around 4.5% level. In the Eurozone, the economy stagnated in Q4 2024, with 0.0% QoQ growth, reinforcing concerns over sluggish demand and subdued business activity. The European Central Bank cut its key interest rate by 25bps to 2.75%, marking its fifth reduction in this cycle. The move highlights the ECB’s continued focus on stimulating growth as inflation continues to moderate across the bloc.

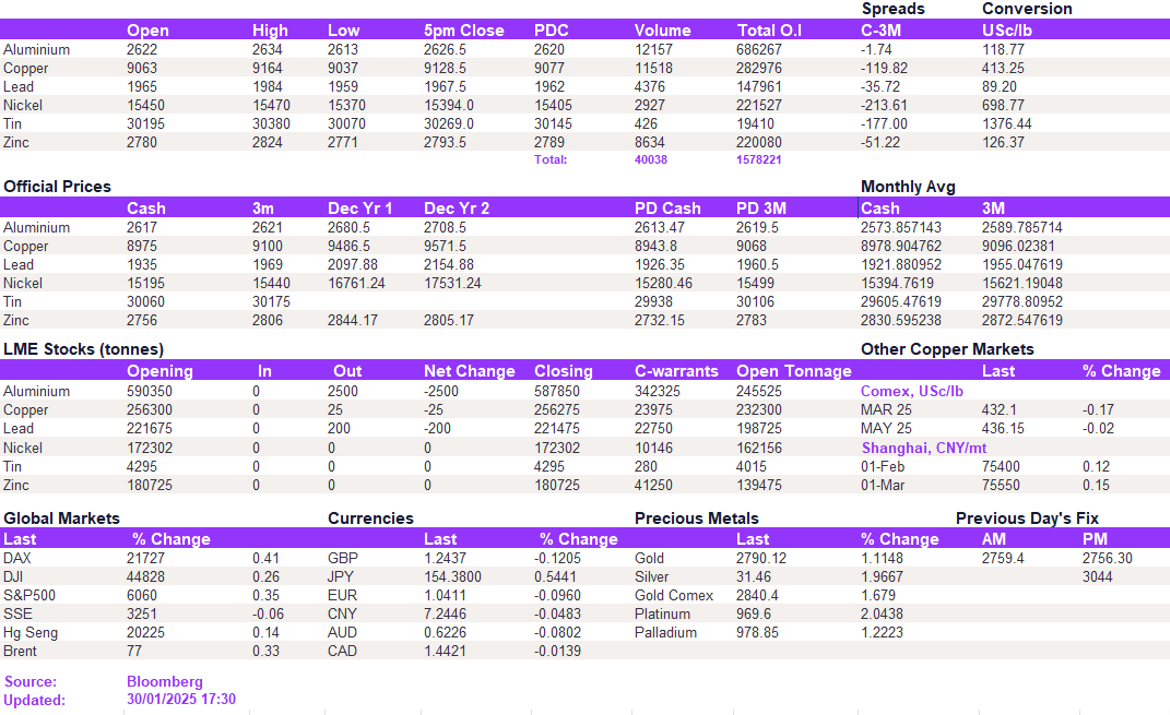

Base metals edged slightly higher today as markets assessed the broader trade implications of US tariffs on aluminium, copper, and steel imports. A softer dollar also supported the moderate risk-on sentiment. Aluminium remained above the $2,600/t level, closing at $2,626.50/t. Copper also continued to edge higher, holding above the $9,100/t level. Lead and zinc are showing signs of bottoming out, solidifying support levels at $1,950/t and $2,750/t, respectively. Nickel is the only exception, as it continued to fall, breaching the $15,500/t support level to $15,370/t.

Gold surged to a new record high, approaching 2,800/oz, as a weaker dollar supported safe-haven demand. Silver also broke out of its recent range, climbing to 31.5/oz, the highest level since early December, signalling renewed interest in the metal's investment appeal. Oil prices saw early declines but rebounded later in the session, with WTI trading at 73.3/bbl and Brent crude at 77.3/bbl at the time of writing.

All price data is from 30.01.2025 as of 17:30