Improving Market Activity Supports Base Metals Momentum

Summary

- The US trade deficit widened significantly in December as businesses accelerated imports ahead of potential tariffs. The dollar weakened, falling to 107.4 as a result.

- We anticipate a moderate strengthening of base metals as Chinese participants gradually return to the market after the holidays.

- Gold extended its record-breaking rally as safe-haven demand remained strong, while silver held firmly above $32.0/oz. Oil prices declined amid concerns over weaker global demand.

US stocks opened lower today as markets reacted to a sharply widening US trade deficit, signalling increased pressure on external balances. The trade deficit surged to $98.4 billion in December, a 25% increase from November, marking the largest monthly gap since early 2022. This jump was primarily driven by a surge in imports, as businesses front-loaded purchases to mitigate potential cost increases ahead of Trump’s proposed tariffs. The rush to secure foreign goods ahead of policy uncertainty led to an artificial inflation of import volumes, exacerbating the trade imbalance. For the full year, the US trade deficit reached $918.4 billion in 2024, reflecting persistent structural trade imbalances and the challenge of reducing reliance on foreign goods. Labour market data showed continued resilience, with ADP employment change surpassing expectations at 183k in January, up from an upwardly revised 176k in December. The stronger-than-expected payroll figure suggests that hiring remains steady despite concerns over slowing economic momentum and ongoing trade policy uncertainty. The US dollar weakened significantly, with the dollar index falling to 107.4, pressured by the widening trade deficit and shifting market sentiment following recent economic data. Meanwhile, the 10-year US Treasury yield dropped to 4.4%, the lowest level since mid-December, as investors moved into bonds amid growing uncertainty over trade policy and its potential economic impact.

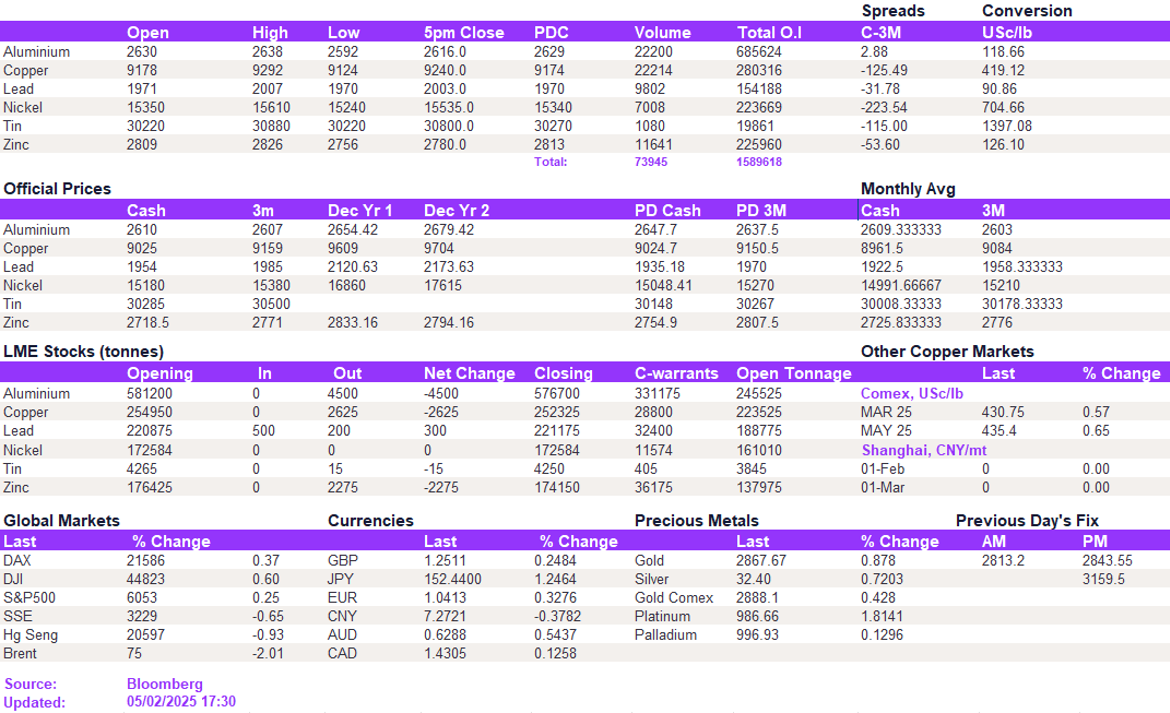

Base metals experienced moderate risk-on sentiment due to a weaker dollar and the gradual return of Chinese participants to the market after the holidays. We expect that a continued increase in liquidity will further support the complex on the upside in the coming days. Copper is approaching the resistance level of $9,200/t. Aluminium remained subdued, staying above the $2,500/t mark, even though the cash to three-month spread is in backwardation, indicating fundamental tightness in the market. Lead surged higher, testing a key resistance level of $2,000/t; we believe that a break above this level could lead to further gains. Nickel also rose above $15,500/t.

In the precious metals market, gold extended its record-breaking rally, reaching $2,871/oz as safe-haven demand remained strong. Silver also gained, holding firmly above $32.0/oz and trading at $32.3/oz at the time of writing. Oil prices declined, with WTI at $71.5/bbl and Brent crude at $74.9/bbl, reflecting concerns over weaker global demand.

All price data is from 05.02.2025 as of 17:30