Executive Summary

Global Economic Landscape:

- A lack of clarity on US tariff policies under Trump adds to market volatility, creating uncertainty in global trade dynamics.

- The case for the rate cuts across the world lessened as economies deal with stickier inflation prints.

- Europe and China are the only exceptions, expected to implement moderate cuts in 2025.

- Brazil's fiscal challenges are set to weigh on the BRL through the first half of 2025.

Corporate Performance:

- Coffee chains are under pressure to perform well this year as new management takes over.

Regional Supply Dynamics:

- Brazil remains a dominant player in the coffee market, with farmers leveraging high domestic prices to maintain strategic selling practices despite wider dollar-based discounts.

- Supply constraints persist, driven by weather-related stress and the European Union Deforestation Regulation (EUDR), set to take full effect in December 2025. This has spurred pre-emptive stockpiling among European companies, contributing to certified stock growth to just under 1 million bags.

Global Coffee Market Challenges:

- Central American coffee output has been sharply reduced by dry weather and labour shortages, with Guatemala and Honduras among the hardest hit.

- Robusta availability faces increasing pressure due to delayed harvesting in Vietnam and critically low stocks in Brazil, expected to be depleted by February.

Stock Levels and Market Vulnerabilities:

- Brazil’s buffer stocks have eroded to an estimated 500,000 bags, significantly below the traditional 8 million, leaving the market vulnerable to further disruptions.

Supply Tightness and Price Pressures:

- A wide producer net short position reflects heavy hedging activity, while uncovered roasters face intensified competition for physical coffee, likely driving prices higher as supply tightens.

Our View

Macro Overview

US

As we start 2025, all eyes are on the early actions of the newly inaugurated President Trump and the policies his administration is set to implement. Speculations are mounting over the possibility of a more inflationary economic agenda under his leadership, particularly concerning new tariff policies that could further strain trade relations with other countries and create supply chain bottlenecks. However, a lack of clarity regarding the specifics makes it difficult for markets to accurately price in these potential shifts, contributing to anticipated market volatility. For now, a greater focus is being placed on the broader implications of Trump on the US's inflationary outlook over the long term. As a result, most hedging strategies are centred around US assets, such as bonds and the US dollar, which are seen as key instruments for navigating potential market volatility during his tenure.

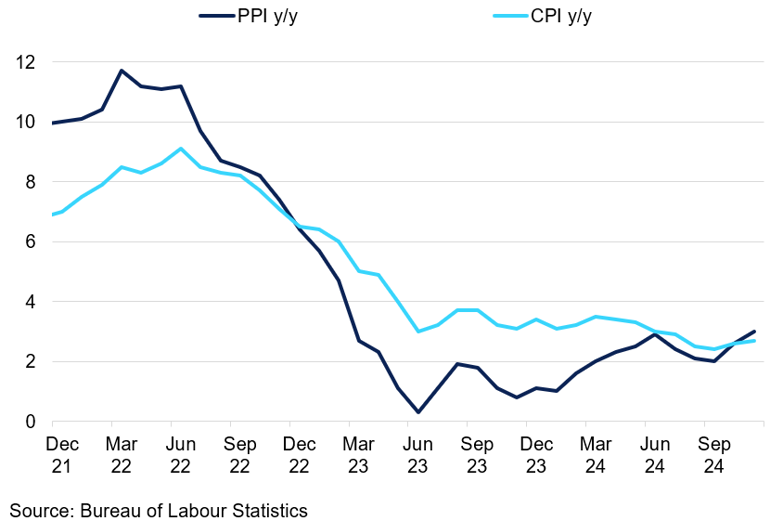

From the macroeconomic perspective, recent inflation data shows that while food and oil prices add to headline print fluctuations, persistent costs in services and shelter are keeping core inflation consistently elevated. In November, these metrics grew by 2.7% and 3.3% YoY, respectively. Although we expect inflation is expected to ease further this year, the decline may be gradual with a potential for reacceleration in H1 2025.

US CPI and PPI Growth YoY

Both CPI and PPI prints are pointing to a potential reacceleration of pricing pressures.

This reduces the urgency for the Fed to make aggressive rate cuts. Already, markets have repriced their expectations to 25bps worth of cuts being implemented in 2025. We anticipate a 50-75bps reduction in interest rates from the Fed this year. Still, we see limited downside for the USD in the months ahead, bolstered by Trump’s leadership and Fed’s cautious stance. However, we believe that any sudden changes in current macroeconomic landscape or delays in tariff implementation could significantly impact market sentiment, leading to a USD selloff.

Europe

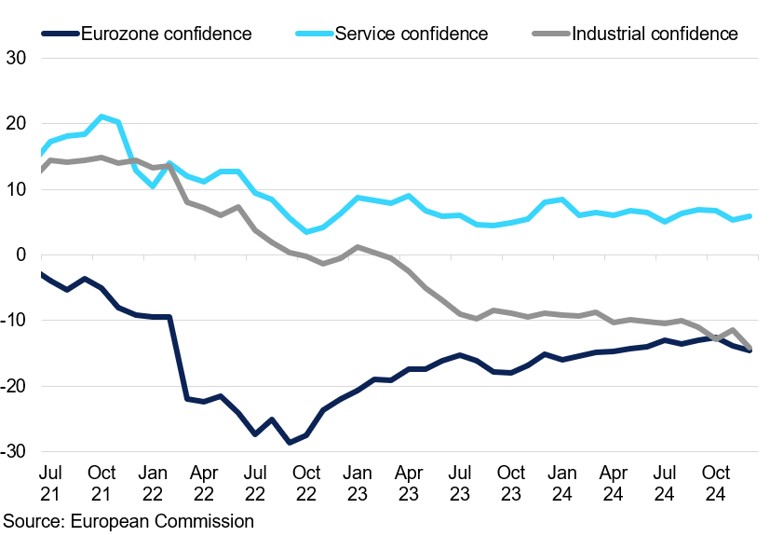

The European market has experienced significant uncertainty in recent months, brought in by political instability and ongoing economic challenges. In particular, recent government reshuffles in France and Germany have raised concerns over the political strength of the Eurozone's two largest economies, as continued disputes between left and right-wing parties are complicating expenditure plans for the coming years. Even with new administrations in place, several major European economies will continue to grapple with budget uncertainties. As of early 2025, at least four European countries have yet to submit viable budget plans, leaving the fiscal plans unsolved and adding to political risks.

Additionally, Trump is creating significant uncertainty for the EU in 2025. With European elections approaching, the political and trade relationship with the US remains highly uncertain. Moreover, if additional tariffs on Europe are implemented, policymakers will have a limited set of tools to support the economy, which is heavily reliant on trade. The most significant tool available is the ability to cut interest rates, and if necessary, this should be implemented aggressively.

Since June 2024, the ECB has already implemented 135bps worth of cuts. While at a faster pace than the Fed, the ECB will also slow down on the pace of cuts relative to what was originally anticipated. We expect two 25bps cuts in the first two meetings of the year, with quarterly assessments thereafter.

European confidence indicators

Industrial and overall confidence indicators point to a worsening outlook in the EU.

China

As 2025 begins, China faces a different start compared to previous years. Confidence in a post-pandemic recovery has largely faded as industries are struggling to rebound. The main concern remains on the inflation front. Consumer prices are stagnating, rising only by 0.1% vs. 2.0% before the pandemic, given falling prices in the transportation and housing sectors. Consumer purchasing power is weak, and a real estate slump continues to dent confidence, discouraging people from making big purchases.

China's economic growth, while not as strong as it was before the pandemic, is still outpacing many developed nations with a 5% GDP growth rate and 5.3% YoY growth in consumer spending. Since the pandemic, China has entered a new phase of growth, shifting from a focus on industry to a consumer-driven economy, which is crucial for its development into a more advanced nation. While this transition may reignite growth in China in the long run, markets are likely to lower short-term expectations, impacting overall confidence.

China house diffusion index vs completed investment in real estate

Real estate investment has plateaued, suggesting that the construction segment might be stabilising at current levels.

We expect that the government will continue to inject fiscal stimulus into the economy in addition to monetary policy easing; however, market optimism is likely to be muted. Instead, fiscal stimulus is expected to act as a buffer against further economic downturns. We expect that by H2 2025, China will reach a plateau, followed by a period of stabilisation and moderate recovery.

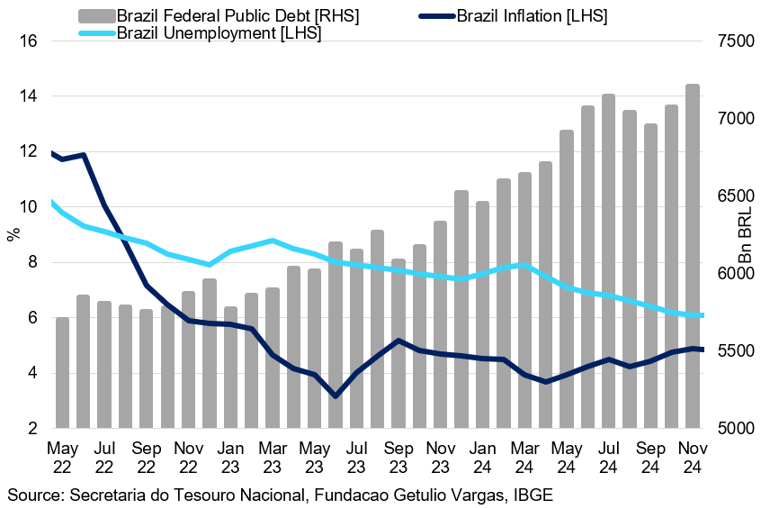

Brazil

Brazil has experienced significant selling pressure in financial markets following President Lula's commitment to address the country's soaring fiscal deficit. The government proposed measures to cut 70bn reais in spending as part of its efforts to shore up public accounts. However, investor scepticism emerged due to concerns about the effectiveness of proposed measures, particularly in light of other fiscal policies that may offset the impact of spending cuts. As a result, a mass of pessimism flooded the Brazilian markets, weakening the BRL by 17% against the dollar to a record low of 6.31, as the Ibovespa index weakened by 12%.

To calm the markets, lawmakers considered watering down the proposal, such as prohibiting tax benefits if public finances worsen and limiting increased spending for civil servants. However, the heavy burden falls on the Brazilian central bank. In December, the central bank intervened to control the currency slide by selling more than $5bn in local markets. Fiscal negotiations are expected to continue into the first half of this year, influencing the direction of the BRL in the coming months.

Brazilian Fiscal and economic indicators

While the economy remains strong, federal public debt continues to rise, contributing to the fiscal crisis.

Despite tight credit conditions, Brazil's economy continues to grow, with unemployment near record lows and wages gaining momentum. While this news is positive for the economic health of the nation, it also raises concerns that the economy may be overheating, as inflation is also increasing. In December, policymakers followed through with a 100bps interest rate hike to 12.25% in an effort to curb persistent inflation. We anticipate that the BCB (Central Bank of Brazil) will raise interest rates in the coming months. However, this move is likely to worsen the current deficit by increasing borrowing costs for the government.

Corporate Results

Starbucks

Starbucks finished its fiscal year 2024 on the back foot, reporting a decline in global comparable store sales, which were partially offset by higher ticket prices. North America and the US store sales weakened by 6%, while the international segment declined by 9%. While new store openings offset some of the losses, total net revenue fell by 3% to $9.1 billion. Overall, net earnings were $909 million, down from $1.2bn in the previous year.

In 2024, Starbucks faced a year marked by boycotts, price increases, and slow services, all contributing to lower sales. Under the leadership of new CEO Brian Niccol, Starbucks is expected to undergo significant changes in 2025, including a reduction in menu complexity and wait times. While these changes are expected to bring positive growth in the long term, we anticipate that short-term profitability might suffer, given the necessary costs to achieve this.

On top of structural changes, the products' affordability and, in turn, popularity are another key concern. In China, which accounts for nearly 20% of Starbucks outlets, same-store sales plummeted by 14% year-over-year, compared to a 6% decline in the US. The reason behind this is the growing preference in China towards more affordable local competitors. Tackling these issues would be key in assessing Starbucks's path forward.

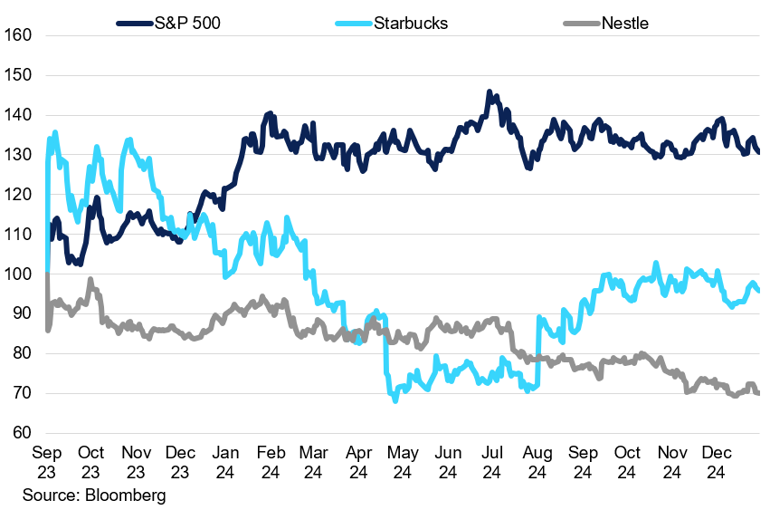

Starbucks vs Nestle vs S&P 500 Performance

Nestle’s performance continues to worsen, significantly underperforming the S&P 500.

Nestle

Nestlé's shares are currently hovering around their lowest levels since 2017, having declined by more than 25% this year. A tough macroeconomic environment and changing consumer habits have weakened the company's performance outlook.

Nestle's organic sales growth was 2.0% for the first nine months of the year and 1.9% in Q3 2024, with growth led by coffee segments. However, overall real internal growth was impacted by softening consumer demand, lower customer inventory, and consumer hesitancy towards global brands, which were linked to geopolitical tensions.

The segment that faced the most difficulties in Q3 2024 was North America, recording a decline of -0.8%. In contrast, Greater China led geographical sales with a growth rate of 4.5%. While China excelled in overall sales, the performance of the coffee segment varied across regions. Nespresso posted modest sales growth of 1.9% in Q3 2024; North America experienced mid-digit growth, while Europe saw slightly negative growth. To counter the impact of rising coffee prices, the company is implementing price increases while reducing package sizes.

Supply

Brazil

As we enter the new year, Brazilian coffee farmers maintain a strong market position, supported by high domestic prices and strategic selling practices. Over the past year, Brazil’s coffee exports have been high, influenced by the EUDR. This regulation, set to take full effect in December 2025, requires exporters to ensure that coffee entering the EU has not contributed to deforestation or forest degradation. To comply, exporters must provide traceability documentation, which has prompted many to frontload shipments to avoid disruptions or delays under the new rules.

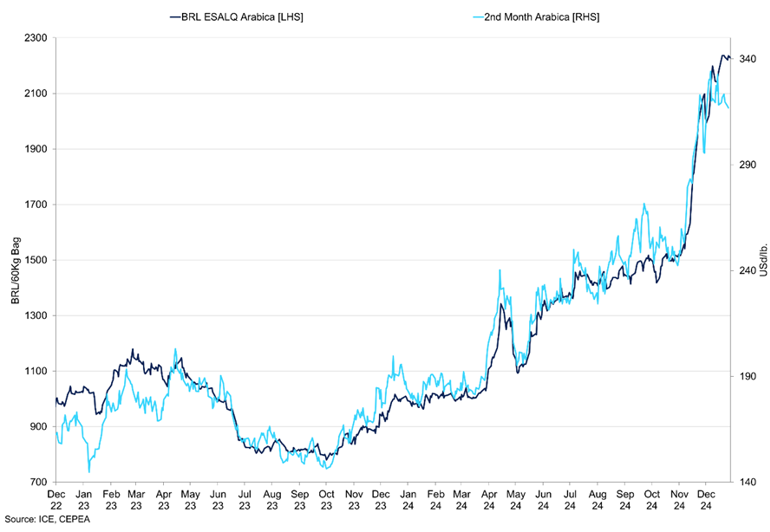

Brazilian farmers prioritize prices in their local currency, the Brazilian real, rather than in US dollars. Over the past two years, domestic coffee prices have risen sharply, from 1,000 reals to nearly 2,300 reals per 60kg bag. This increase has significantly strengthened farmers’ financial positions, reducing their dependence on higher dollar-denominated prices. Despite wider dollar-based discounts (from 40 cents to 80 cents below benchmark prices over the past two years), farmers remain less pressured to tighten these differentials. Their strong local earnings enable them to sell strategically and avoid weaker price points, reinforcing their advantageous position.

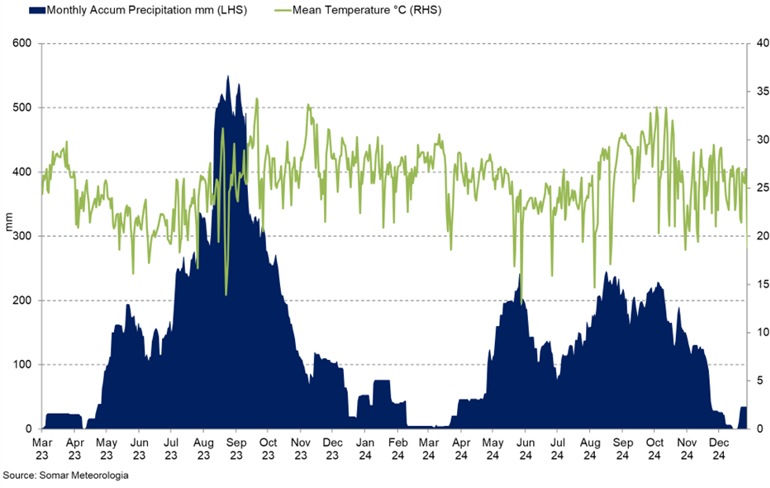

Adverse weather conditions during the growing season continue to weigh on Brazil’s coffee outlook. From April to September 2024, the country experienced extreme dryness and heat, placing significant stress on coffee trees. Although rains returned in October and November and improved further in December, their impact on bean development remains uncertain. Estimates for the 2024/25 Arabica crop range from 34.4 million to 43 million bags, with a consensus of 38–40 million bags. This reflects the cumulative stress on coffee trees since the 2021 crop, with some experts suggesting yield reductions may persist into future seasons.

Brazil Coffee Local Price vs 2nd month Arabica

Domestic coffee prices have risen sharply.

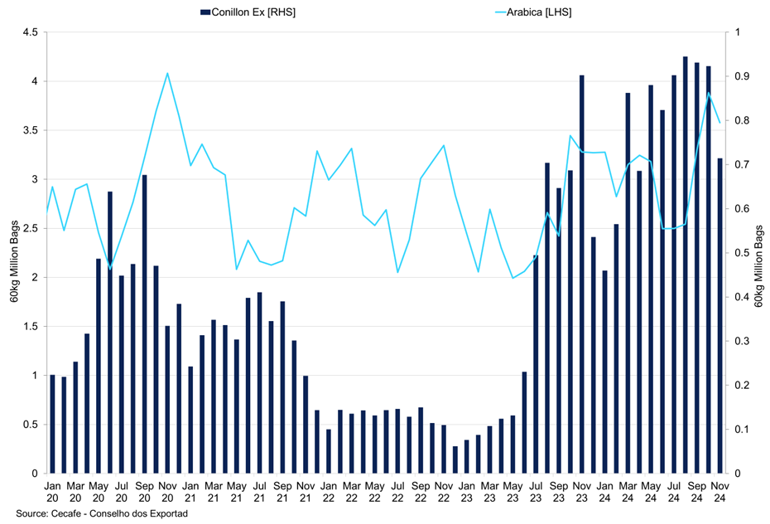

Between December 2023 and November 2024, Brazil exported 37.25 million bags of Arabica coffee, an increase of 4.68 million bags compared to the previous three-year average of 32.57 million bags. The 2024/25 crop year (July to June) has seen strong export activity in its first five months, with total exports reaching 22.11 million bags, including 16.10 million bags of Arabica, 4.42 million bags of Conilon and 1.77 million bags of soluble coffee. During this period, domestic consumption is estimated at 9.17 million bags, averaging 1.83 million bags per month. Total coffee disappearance for the first five months stands at 31.27 million bags.

Brazil Weather

Particularly dry year has raised fears of a weaker crop.

Brazil Conilon vs Arabica Exports

We have seen an increase in exports due to the announcement of EUDR implementation.

With total production for the crop year projected at 63 million bags, approximately 31.73 million bags remain for the next seven months, equating to 4.53 million bags per month. After accounting for domestic consumption, only 2.7 million bags per month are available for export for the remainder of the crop year. This tight balance highlights a constrained supply environment, particularly as weather-related stress and regulatory changes limit flexibility. Moving into Q1 2025, this combination of high domestic prices and uncertain production estimates suggests continued upward pressure on global coffee prices.

Central America and Colombia

The coffee flow out of Central America has been notably slow, with the region grappling with prolonged dry weather, which has led to downward revisions in production estimates. Guatemala's output is now expected at just 3.0 million bags, the lowest level in years. Honduras, which once produced over 7 million bags annually, is now projected to deliver only 4.2 million bags this season. These declines are exacerbated by a labour crisis, as an aging farmer population and the migration of younger workers to the United States have significantly reduced the available workforce for coffee production.

Adding to the challenges, differentials for coffee from Central America, particularly Nicaragua, have come under increasing pressure. This is partly due to limited access to financing for coffee trade in the region, a lingering consequence of last year’s bankruptcy of Mercon Coffee Group, one of the world's largest coffee traders. The financial difficulties culminated in the closure of Nicaragua's largest coffee exporter, CISA Exportadora, which was a subsidiary of Mercon. These events have left a lasting impact on Nicaragua’s coffee trade, with buyers and financial institutions becoming more cautious. This has further strained the flow of coffee supply from the region, compounding the challenges posed by adverse weather and labour shortages.

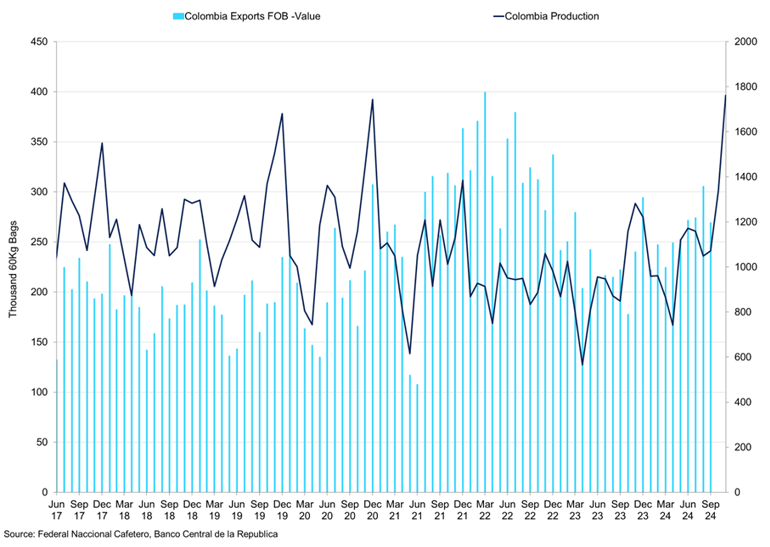

In contrast, Colombia has shown resilience, with November production reaching 1.76 million bags—a 37% increase compared to the same period last year. However, even in Colombia, differentials are under some pressure, with Colombian coffee trading at a premium of 5 cents per pound above the benchmark reflecting the broader challenges faced by coffee exporters across the region.

Colombia exports vs colombia production

Colombia production has improved compared to the previous season.

Robusta

The Robusta coffee market is navigating tightening supply conditions as the crop year progresses, driven by delays in harvesting and dwindling global stocks. In Vietnam, cloudy weather and light rains in December have slowed harvesting slightly, but no major quality issues are expected for the upcoming crop. However, progress remains behind schedule in key regions such as Dak Lak and Long Doc, with only 30% of the crop sold so far—below initial estimates. This figure is expected to reach 40% before the Tet holidays as farmers adopt a strategic approach, holding onto their coffee in anticipation of higher prices in the coming months.

Vietnam’s 2024/25 crop is forecast at 28 million bags, cementing its crucial role in meeting global Robusta demand. Farmers have shown resilience, aware that the industry will soon need their coffee. Producers are unwilling to sell at lower price levels, likely maintaining upward pressure on prices in the short term.

Globally, every available bag of Robusta will likely be required by the second half of the year—or even earlier. Brazil’s Conilon stocks are projected to run critically low by the end of February, further straining supply. Indonesia has provided some relief with competitive differentials of around +1 USD/ton, but its exports alone cannot fully satisfy market demand.

Interest in certified stocks in London is expected to peak soon due to limited availability, despite the arrival of additional volumes from Indonesia and Conilon producers. The market is also influenced by the Arabica-Robusta price spread, which currently stands at 93 cents on March–March contracts and 92 cents on May–May contracts. While buyers are actively securing Arabica, ongoing tightness in Robusta supply will eventually force many to shift their focus to Robusta to fill the gap.

As the second half of the year approaches, competition for Robusta supplies is expected to intensify. With demand far outpacing availability, producers are likely to maintain firm pricing strategies, knowing their coffee is essential to global needs. This tightening supply environment reinforces a bullish outlook for Robusta prices in the coming months.

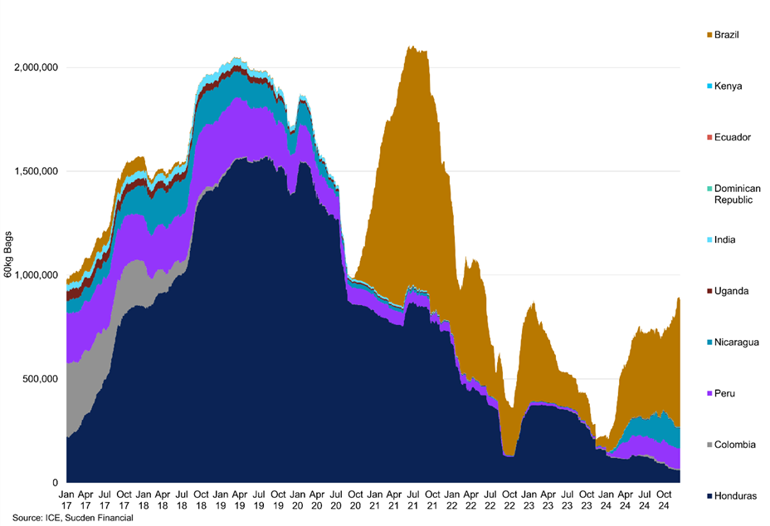

Inventories

Certified coffee stocks have steadily increased this year but remain well below the 2 million bag levels anticipated a few years ago, currently standing at just under 1 million bags. This modest rise has been driven in part by European companies bolstering inventories in preparation for the EUDR initially set for implementation but now postponed to December 30, 2025. This pre-emptive stockpiling is reflected in

Brazil's inventory figures, which show 621,134 bags, a steady increase throughout the year. Nicaragua and Peru have also contributed to the rise, with stocks now at 95,834 and 96,507 bags, respectively. In contrast, Honduras has seen its coffee stocks decline, with the latest figures standing at just 58,788 bags.

Brazil’s stock situation remains a key concern in the market. Weather challenges over the years have severely impacted its ability to maintain buffer stocks. The frost of 2021 marked a critical turning point, echoing the impact of past weather events like the 1975 frost and subsequent droughts and frosts in the 1980s and 1990s, which occurred roughly a decade apart. This time, however, the shocks have come in quick succession, with major disruptions occurring within just four years. Recovery appears distant, with hopes pinned on 2026 at the earliest.

Coffee inventory levels per location

Brazil, Nicaragua and Peru have contributed to the rise in stocks.

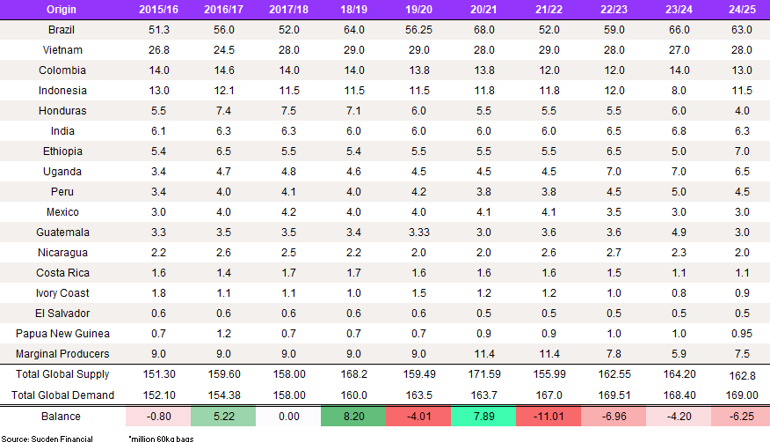

Looking at historical data, Brazil’s 2019/2020 crop was estimated at 56.25 million bags, followed by a record-breaking 2020/2021 crop of 74–75 million bags, thanks to ideal weather conditions. However, subsequent years saw production drop significantly due to adverse weather, with output at 52 million bags in 2021/2022, 59 million in 2022/2023, and 65 million in 2023/2024. The current 2024/2025 crop is estimated at 63 million bags, resulting in an average production of 62 million bags over six years.

Over the same period, Brazil’s coffee exports averaged 42.143 million bags annually, and domestic consumption was approximately 21 million bags, totalling 63.143 million bags per year. This has created a deficit of 6.618 million bags over six years, eroding Brazil’s buffer stocks. Traditionally, Brazil has maintained a working stock of 8 million bags, but current estimates suggest that stocks may now be as low as 500,000 bags. With minimal buffer stocks to absorb future shocks, any additional weather disruptions could have an outsized impact on global coffee prices and availability.

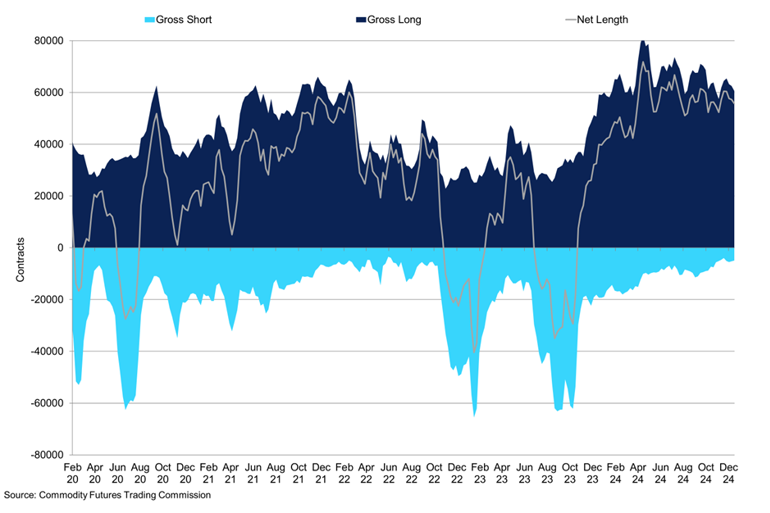

COT

As we enter the new year, the Arabica coffee market remains a focal point for investors, driven by persistent supply concerns. Over the past months, expectations of lower yields due to the dry weather conditions between April and October have been a central focus in market discussions. This concern has kept the net long positions of managed money robust, indicating a strong bullish sentiment in the market. As of January 6th, the net length for managed money in Arabica stood at 41,753 contracts. This figure is nearly double that of the same time last year, and although it has receded from its peak last April, it reflects ongoing optimism regarding future price increases. There has been a consistent bullish stance with gross long contracts maintaining levels above 50,000 for most of the past year. The count as of January 6th reached 50,912 contracts, underscoring strong confidence in rising coffee prices. The historically low number of short positions at 9,158 as of 6th Jan, which have been declining over the past few months, suggests a trend of covering shorts to minimise losses amid rising coffee prices. This reduction in short positions signals that traders are less inclined to bet against the market, reinforcing the bullish outlook.

Arabica Managed money

There has been a consistent bullish stance with gross long contracts maintaining levels above 50,000 for most of the past year.

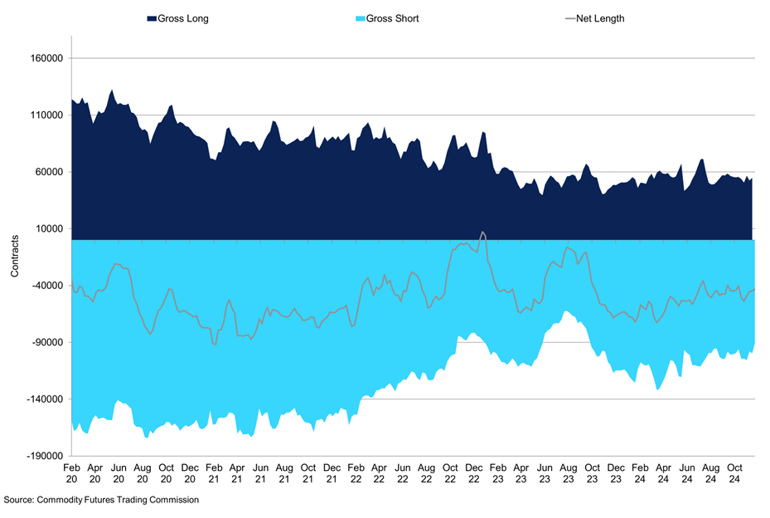

From the commercial perspective, gross long positions have remained relatively stable, showing minimal movement over the year, indicating limited speculative activity among commercial participants. Meanwhile, the net short position has been consistently wide, standing at 144,844 contracts, roughly equivalent to 40 million bags, a volume that exceeds the annual Brazilian Arabica crop. The resulting wide net short position of -94,313 underscores the tight supply dynamics in the market. While these hedging strategies are essential for mitigating financial risks, they pose challenges for roasters, who require physical coffee for their operations. A heavily hedged market indicates that much of the future supply is already financially committed, leaving less unhedged coffee available. For uncovered roasters, this will likely result in intensified competition for physical supply, further driving prices higher in an already constrained market.

Arabica Commercials

From the commercial perspective, gross long positions have remained relatively stable.

From our collective analysis, we recognise that roasters are currently under-covered and facing challenges due to elevated prices. They are hopeful for potential liquidation from index funds, which could help moderate prices to more manageable levels. However, this hope may be in vain. We understand that many index funds have already secured their profits given the high market prices, and thus, the likelihood of significant liquidation driving prices down appears increasingly slim. This situation underscores a crucial insight: despite the high demand and hopes for price adjustments, the market might not see the anticipated relief from fund liquidations, as the funds have efficiently capitalised on the favourable conditions earlier in the year.