NY 2nd Month Sugar Futures

NY sugar futures edged higher yesterday, but resistance at 40 DMA caused the market to close at 17.98. The stochastics are rising, with %K/%D converging on the upside and now rising, and the MACD diff is positive and diverging, suggesting a strong upside momentum in the near term. If the futures struggle above the 40 DMA at 18.02, then we could continue to see losses on the downside. A break of the 10 DMA at 17.87 could trigger losses through 17.62. On the upside, a break above 40 DMA could set the scene for bullish momentum towards the month's high of 18.44. The spinning top formation has been formed, which points to market indecisiveness, however, a fall above the current resistance would confirm a growing bullish momentum.

Ldn 2nd Month Sugar Futures

Lnd sugar futures edged marginally higher, but the bullish momentum was not strong enough to break above 550 completely, and futures closed at 547. The stochastics continue to rise yet seen converging on the downside, as %K is seen tailing off near the overbought, whereas the MACD diff is is positive and continues to diverge. The rejection of prices at 550 has formed a candle with a narrow body but a long wick on the upside, suggesting markets are testing and rejecting prices above near resistance. If prices were to break above this level, this could trigger a test of 560, the July highs. To confirm the shooting star formation, futures need to take out 10 DMA at 535.28 and then robust support at 530.20. A break below this level would confirm the outlook for lower prices.

NY 2nd Month Coffee Futures

NY coffee softened yesterday as protracted selling pressure triggered a breakthrough of 225 and closed on the back foot at 220.70. The stochastics are falling, with %K entering the oversold territory, highlighting the recent selling pressure. The MACD diff is negative and diverging, suggesting increasing downside pressures; this could set the scene for lower prices towards the 100 and 40 DMA support levels at 220. A break below this would confirm the trend for falling prices, down to 212.60. On the upside, resistance at 10 DMA at 228.14 has proven to be strong before, and support above that level would strengthen the bullish momentum. This could also trigger gains towards the 240. Long candle body along with longer lower wick point to an increased appetite on the downside, however, the futures need to break completely below 40 and 100 DMAs to confirm the outlook.

Ldn 2nd Month Coffee Futures

Ldn coffee futures edged marginally lower yesterday as intraday trading saw prices test support at 10 DMA. The market closed at 2239. The RSI is falling, and %K/%D is about to converge on the downside. The MACD diff is positive and converging, suggesting growing selling pressures. The indicators point to lower prices in the near term, and to confirm the rejection of the support; prices need to take out 10 DMA at 2246. Appetite for prices below this level could trigger a test of 2215. Alternatively, a break back above 2281 would confirm that the upside trend is not yet over and a subsequent bullish momentum. A narrow candle body after similar candles shows a lack of conviction in recent days, signalling uncertainty about the outlook for lower prices. The futures need to take out the 10 DMA level to confirm the outlook for falling prices.

NY 2nd Month Cocoa Futures

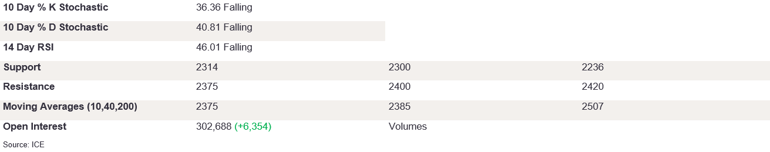

NY cocoa weakened yesterday as marginal selling pressure triggered a close on the back foot at 2350. The stochastics are falling, and the RSI has also edged lower, sending a sell signal. The MACD diff is negative and diverging. A full bearish candle suggests growing selling pressures; this could set the scene for lower prices to break below the 2314 support level. This would confirm the trend for falling prices, down to the 2236 level. On the upside, resistance levels at 10 and 40 DMA at 2375 and 2385, respectively, have proven to be strong, and support above that level would strengthen the bullish momentum. This could also trigger gains towards the 2420 level. The bearish engulfing pattern suggests an impeding market downturn, and we expect prices to continue to fall in the near term.

Ldn 2nd Month Cocoa Futures

Ldn cocoa futures opened lower but managed to increase marginally yesterday as trading saw prices close at 1838. The stochastics are seen diverging on the downside, with the %K/%D edging close to the oversold, and the MACD diff is negative and diverging. To suggest the outlook of higher prices, futures need to close back above 1837 and then target 1850 before 1900. However, a break below support at 1820 could set the scene for 1800 and then the DMA support levels. The narrow candle body with long upper and lower wicks points to a lack of appetite in either direction yesterday, and the futures need to break out of current resistance/support to confirm the near-term outlook.