NY 2nd Month Sugar Futures

NY sugar futures started the day on the front foot but softened slightly on the day after finding resistance at 26.15. The market closed at 26.03. The stochastics are gaining ground in the overbought territory, and the MACD diff is positive and diverging, suggesting we could see higher prices in the near term through near-term resistance. A break below the moving averages at 25.20 would bring into play the 24.09 level, which could set the scene for 24.00. On the upside, futures need to gain back above 26.15 in order to confirm upside momentum. The appetite above that level could trigger gains towards the 26.37 level; this could strengthen the trend in the long run on the upside. The hanging man formation, where there was marginal weakness during the day, could point to an end of the uptrend; however, the short candle body point to market uncertainty about the change of trend.

Ldn 2nd Month Sugar Futures

Ldn sugar prices gained marginal ground yesterday, but futures struggled to break completely above 701, closing at 701. Stochastics favour the upside, with the %K/%D being overbought and growing, suggesting we could see prices improve in the near term. The MACD diff is positive and diverging, pointing to an improved outlook. The RSI is rising, and yesterday’s longer lower wick suggests we could see prices challenge 711.60 once again in the near term. In the medium term, futures need to hold above the recent high of 718.20 to trigger a strong upside momentum. On the downside, a break below the moving averages at 685 could trigger losses back to 661.10. Futures are being supported by the shorter-term moving averages in the meantime, and we expect further upside in the near term, but futures need to break the 700 level first.

NY 2nd Month Coffee Futures

Prices weakened yesterday as moderate selling pressure triggered a below the 10 and 100 DMA levels at 181.05; the market closed at 176.10. The stochastics are falling moderately, and %K/%D is diverging on the downside, signalling a continuation of the downward trend. The MACD is negative and diverging, and the long candle body supports yesterday’s decisiveness below this level. Prices have been trading in a narrow range in recent weeks, and in order to confirm the change of momentum back in these ranges, prices need to break above the current resistance at 100 and 10 DMAs and then 190. Conversely, a break below the 171.85 support level could set the scene for a test of 170. We expect prices to weaken slightly but struggle below the 171.85 level in the near term.

Ldn 2nd Month Coffee Futures

Ldn coffee futures struggled above 2790 once again, closing on the back foot at 2770. The stochastics are rising, with %K/%D seen converging on the downside out of the overbought. The MACD is positive and converging, suggesting waning upside pressures. The rejection of higher prices may prompt a break back towards support at 10 DMA at 2718; a subsequent breach of this level could trigger losses towards 2600. On the upside, a break of 2790 may prompt futures to test a new high at 2800. Longer upper and lower wicks point to an appetite out of the current trading range; however, the future needs to break above 2790 to confirm the outlook on the upside.

NY 2nd Month Cocoa Futures

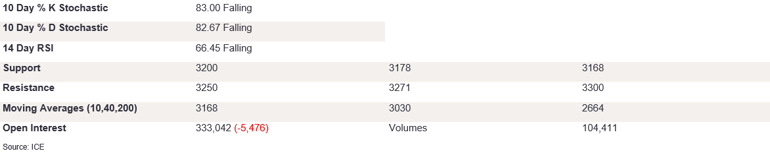

NY cocoa futures edged lower yesterday as moderate downside sentiment caused futures to close at 3211. The stochastics are converging on the downside out of the overbought territory, and the MACD is positive and converging, pointing to a waning buying pressure. The rejection of prices above the longer-term trend level has formed a candle with little shadow, suggesting an appetite for lower prices. If prices were to break below 3178, this could trigger a test of 10 DMA at 3168 and then 3100. On the upside, futures need to take out 3250 once again and then resistance at 3271. Indicators point to further growing pressure, and we expect futures to weaken further.

Ldn 2nd Month Cocoa Futures

Ldn cocoa futures held their nerve yesterday as intraday trading saw prices close at 2476. The RSI and %K/%D are now falling out of the overbought, which could be a strong sell signal. The MACD diff is positive and converging, suggesting some appetite for lower prices, but futures need to break below 2450 to trigger the momentum on the downside. A break below this level towards 2400 would confirm the growing bearish momentum and a change of trend. Conversely, appetite for prices above the 2504 level could trigger a test of resistance 2517. A gravestone doji candle shows rejection of higher prices as futures continue to struggle above that level.