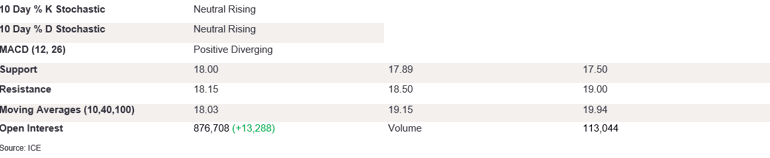

NY 2nd Month Sugar Futures

NY sugar futures held their nerve on Friday after testing the support level of 17.89 once again. The market closed above it at 18.07. The stochastics are rising, with %K/%D diverging on the upside, and the MACD diff is positive and diverging marginally. The reaffirmation of support above the 10 DMA at 18.03 could set the scene for higher prices back to test 18.50, confirming an inverse hammer formation. On the downside, futures need to break below the support of 18.00 and then 17.89 in order to confirm the strong bearish trend. Indeed, the 17.89 support level has been robust in the last couple of months; a break below this level would suggest strong conviction on the downside. The longer upper wick with a narrow body confirms the support is still intact.

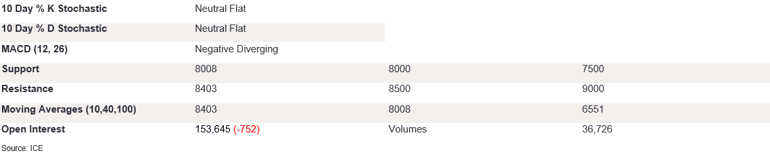

Ldn 2nd Month Sugar Futures

Ldn sugar futures held their nerve on Friday as intraday trading saw prices close at 507.40. The %K/%D is starting to show a growing appetite on the upside. The MACD diff is positive and diverging, suggesting further appetite for higher prices, but futures need to break above the 10 DMA level at 508.87 to trigger the momentum. A break above this level towards 519 would confirm the strong bullish momentum. Conversely, appetite for prices below 500 could trigger a test of support of 493.80. A long-legged doji candle shows indecision about either direction as it traded between 10 DMA and 500 levels; the length of the wicks also points to increased volatility during the day. The indicators point to a further rise in prices, but futures need to close above 10 DMA to trigger the momentum.

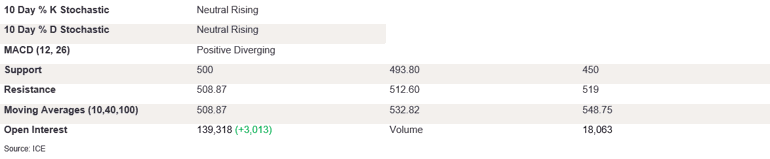

NY 2nd Month Coffee Futures

NY coffee futures edged marginally higher on Friday as prices continued to fluctuate around the 10 DMA level, closing slightly above it at 319.80. The indicators suggest we could see higher prices in the near term. The stochastics are rising, and the MACD diff is negative and converging on the upside. We expect futures to edge higher in the near term towards the trend resistance at 325 - a robust level on the upside. On the downside, if futures fail into 40 DMA at 311.52, this could then set the scene for a strong bearish trend to 304.09 before the long-term support of 300. We expect futures to be firm in the near term; however, as DMAs converge to provide tighter support and resistance, we could see a strong signal, given that one of the levels is broken.

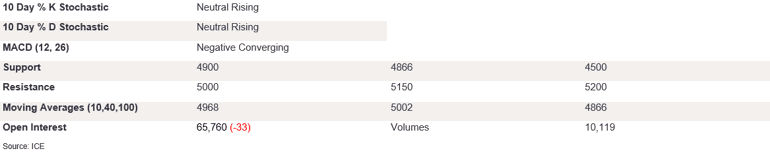

Ldn 2nd Month Coffee Futures

Ldn coffee futures held their nerve on Friday, edging slightly lower during the day as prices closed at 4966. The indicators continue to favour the upside, as %K/%D are diverging on the upside. The MACD is negative and converging. A break below the 4900 level would bring into play the 100 DMA at 4866. In order to indicate an improvement of market sentiment on the upside, futures need to gain a footing above 5000 in the near term. Consecutive bearish doji candles point to market uncertainty, with prices struggling to break higher. The 10 DMA breaking below the 40 DMA confirms the death cross, a strong sell signal. To confirm the indicators’ trend on the upside, futures need to break above the 5000 level first.

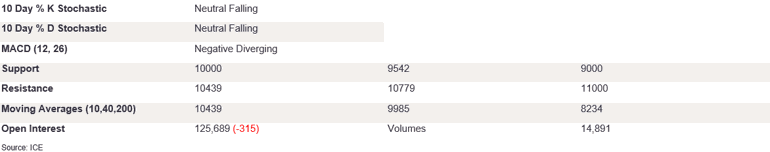

NY 2nd Month Cocoa Futures

NY cocoa futures softened on Friday as moderate selling pressure saw futures test appetite at the 40 DMA around 10000. This level held firm, and futures closed at 10010. The stochastics are falling, with %K/%D converging on the downside, sending a strong sell signal. Likewise, the MACD diff is negative and diverging, suggesting we could see price moderate. To confirm the outlook for lower prices, futures need to break below the psychologically robust support at 10000, which could set the scene for futures to take out the 9500. On the upside, the market needs to take out resistance at 10 DMA at 10439 and then 10779. The 40 DMA level continues to support the futures from the downside; however, with a longer upper wick on Friday, we could see the bears’ strength grow in the near term.

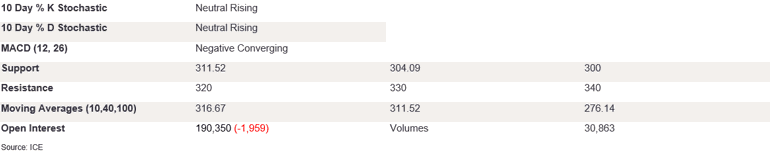

Ldn 2nd Month Cocoa Futures

Ldn cocoa futures held their nerve on Friday, causing the market to close at 8208. The stochastics remain flat, and the MACD diff is negative and diverging marginally, suggesting marginally lower prices in the near term. To suggest an outlook for lower prices, futures need to close back below the 40 DMA T 8008 and then target 8000. At the same time, the 10 DMA is closing in and resisting prices from the upside. However, a break above that level could set the scene for 8500 and then 9000. The narrow candle body with a longer lower wick points to a lack of appetite on the downside, but the futures need to break above the current support of 40 DMA to confirm the indicators’ outlook on the downside.