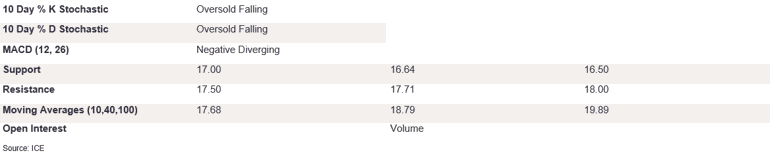

NY 2nd Month Sugar Futures

NY sugar futures held their nerve on Friday as intraday trading saw futures test appetite at 17.00 once again. This level held firm, and futures closed at 17.10. The stochastics are falling, with %K/%D seen converging in the oversold. The MACD diff is negative but is also converging on the upside, signalling waning selling pressures. To confirm the outlook for a potential trend change, futures need to break above the resistance of 10 DMA at 17.68, which could set the scene for futures to take out the 18.00 level. On the downside, the market needs to take out support at 17.00, which has held firmly in recent days, and then robust support at 16.64. A longer lower wick signals the rejection of prices below the 17.00 level. If the futures break above the current resistance of 10 DMA, we could see prices edge higher, and indicators point to a convergence on a downtrend.

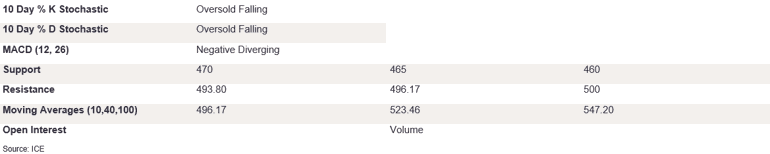

Ldn 2nd Month Sugar Futures

Ldn sugar futures held their nerve on Friday, causing the market to close at 477.40. The stochastics are falling, with %K/%D diverging further into the oversold, and the MACD diff is negative and converging. To suggest the outlook of higher prices, futures need to close back above 493.80 and then target the 10 DMA level at 496.17. Alternatively, a break lower could set the scene for 470 and then 460. A narrow candle body with a longer lower wick point to a lack of appetite on the downside, but the futures need to break above current resistance to confirm the near-term outlook for a trend change.

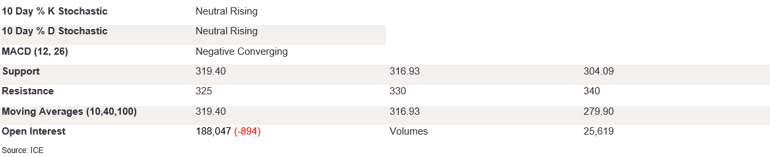

NY 2nd Month Coffee Futures

NY coffee futures held their nerve on Friday as intraday trading saw prices close at 324.60. The %K/%D is rising towards the overbought. The MACD diff is negative and about to converge on the upside, which would send a strong buy signal. To confirm this, futures need to break above the trend resistance, currently at 325, to trigger the momentum. A break above this level towards 340 would confirm the growing bullish momentum. Conversely, appetite for prices below the 10 DMA level at 319.40 could trigger a test of support at 40 DMA at 316.93. A long-legged doji candle shows indecision about either direction, but the indicators point to a continuation of modest gains in the near term. We expect prices to follow the longer-term trend in the meantime.

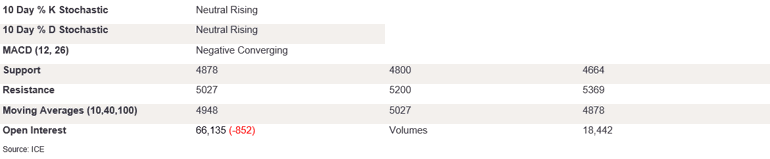

Ldn 2nd Month Coffee Futures

Ldn coffee strengthened on Friday as protracted buying pressure triggered a close on the front foot at 5006. The gains have been capped by the 40 DMA level at 5027, prompting a close below this level. The stochastics are rising, and %K/%D has just converged on the upside. The MACD diff is negative and converging. A long bullish candle body with a long upper wick points to a lack of appetite above the 40 DMA; a break above this level could set the scene for higher prices towards 5100. This would confirm the trend for rising prices, up to 5369. On the downside, a breach of support at 100 DMA at 4878 would strengthen the bearish momentum. This could also trigger losses towards the lower end of the long-term trend, currently at 4750. Indicators point to higher prices, and we expect futures to strengthen in the near term.

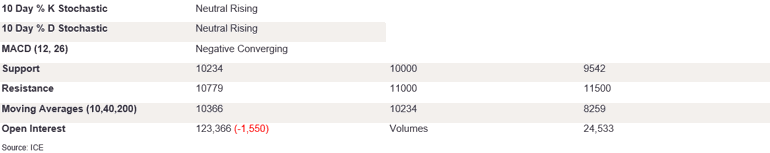

NY 2nd Month Cocoa Futures

NY cocoa futures rallied yesterday as protracted buying pressure triggered a close on the front foot above 10 DMA at 10834. Convergence of the DMA support and resistance levels in recent days prompted a break out of narrow ranges. The %K/%D has converged on the upside. The MACD diff is negative and converging, confirming rising buying pressures. On the downside, a break below the key support level of 40 DMA at 10234 could trigger losses back towards 10000. On the upside, a close above 11000 could trigger gains through 12000 towards 12193, which could challenge new highs. A long candle body points to more certainty in the bullish momentum, and a close above 11000 would confirm the outlook for higher prices.

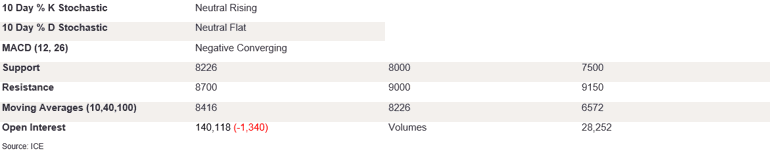

Ldn 2nd Month Cocoa Futures

Ldn cocoa futures rallied yesterday as protracted buying pressure triggered a close on the front foot above 10 DMA of 8416 at 8700. The %K/%D has converged on the upside, sending a strong buy signal. Likewise, the MACD diff is negative and converging. On the downside, a break below the key support level of 40 DMA at 8226 could trigger losses back towards 8000; a break below the 40 DMA would confirm the outlook of lower prices in the longer term. On the upside, a close above 9000 could trigger gains through 9500 towards 9980. A long candle body points to a lack of appetite below the 40 DMA level. This could cause prices to be higher in the near term.