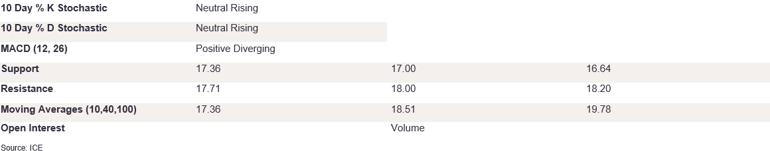

NY 2nd Month Sugar Futures

NY sugar futures edged higher on Friday and closed above the 10 DMA at 17.62. The indicators suggest we could see higher prices in the near term. The stochastics are rising, with %K/%D edged higher out of the oversold territory, and the MACD diff just converged on the upside, sending a strong buy signal. We expect futures to edge higher in the near term; however, the robust resistance levels at 17.71 and 18.00 have to be broken above first before further gains. Superseding these levels, the resistance stands at 40 DMA at 18.51. On the downside, if futures fail into 17.71, then we could see futures break back below the 10 DMA before the 17.00 level. The indicators and a break above the robust 10 DMA resistance level suggest further gains in the near term.

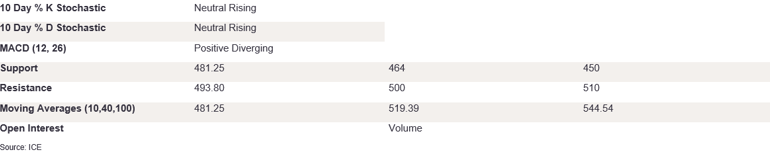

Ldn 2nd Month Sugar Futures

Ldn sugar strengthened on Friday, as moderate buying pressure triggered a close on the front foot at 491.50. The stochastics are rising, with %K/%D diverging on the upside out of the oversold territory. The MACD diff is positive and diverging. A short, bullish candle body with a longer upper wick suggests a robust resistance at 493.80; a break above this level could set the scene for higher prices towards 500. This would confirm the trend for rising prices. On the downside, a breach of support at 10 DMA would help confirm the bearish momentum. This could also trigger losses towards 464. Indicators suggest the futures have further upside, but if prices struggle above current resistance today, prices could pull back in the near term.

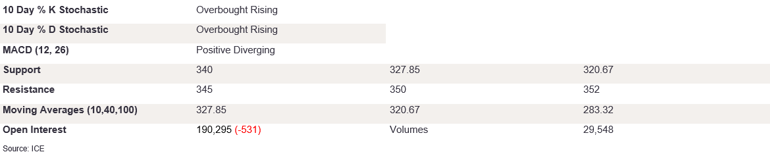

NY 2nd Month Coffee Futures

NY coffee futures continued to edge higher on Friday and managed to close at 343.05. The indicators suggest we could see higher prices in the near term. The stochastics are edging higher in the overbought, and the MACD diff is positive and diverging. On the upside, a break above the 345 level could then test the trend resistance at 350, marking recent highs. On the downside, if futures fail above the current level, we could see futures break back below 340 and the 10 DMA at 327.85. The narrowing DMA levels support price potential, and a break above 350 could pave the way for higher prices in the near term.

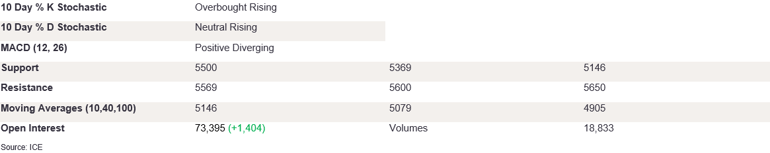

Ldn 2nd Month Coffee Futures

Ldn coffee futures gained ground on Friday but struggled above 5569 to close at 5544. The stochastics are rising but are starting to show signs of waning upside momentum. This suggests we could see a robust resistance form at current levels. On the downside, the candle found support at 5500, and if the prices break through this level, we could see prices retreat back to 5369. The bullish candle with a narrow body and longer upper and lower wicks after a similar candle on Thursday points to growing uncertainty in breaking out of the current resistance level. We expect the trend to reverse in the near term.

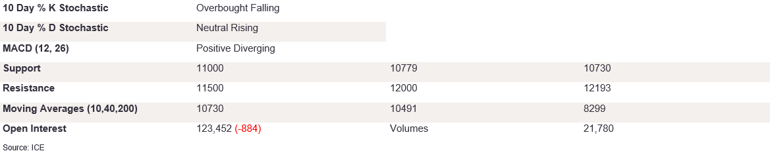

NY 2nd Month Cocoa Futures

NY cocoa futures opened lower but managed to close higher day-on-day at 11411. The stochastics are rising, with %K seen in the overbought but converging. The MACD diff is positive and diverging. On the upside, futures need to break above the robust resistance levels of 11500 and 12000 to trigger the momentum. Prices would then need to take out the recent high at the 12193 level to confirm the longer-term outlook on the upside. Conversely, appetite for prices below 11000 could trigger a test of support of 10779 before 10 DMA at 10730. A doji candle shows rejection of higher prices and could point to an end to the bullish sentiment we have seen in the last couple of days. The indicators highlight a similar trend, and subdued volumes point to market uncertainty about higher prices.

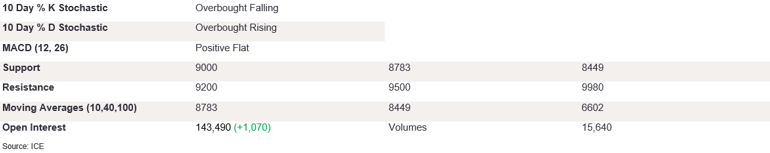

Ldn 2nd Month Cocoa Futures

Ldn cocoa futures edged lower on Friday as prices closed at 9148. The indicators are starting to favour the downside, with %K/%D converging near the overbought area, suggesting growing selling pressures. The MACD, however, lacks convictions. A break below the 9000 level would bring into play the recent sessions’ support level at 10 DMA at 8783. Prices have been capped at the 9500 level, and in order to indicate an improvement in market sentiment on the upside, futures need to gain a footing above this level and then target the April 2024 high at 9980 in the near term. The hanging man candle formation suggests that while there was weakness during the day, the sellers have struggled below the 9000 level. We expect further softness, with the 9000 level retested in the near term.