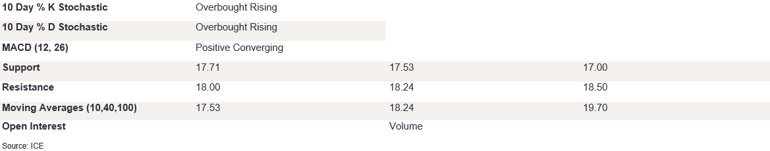

NY 2nd Month Sugar Futures

NY sugar futures softened marginally on Friday after finding support above 17.71. The market closed at 17.88. The stochastics are gaining ground in the overbought territory, but the MACD diff is positive and converging, suggesting waning buying pressures. A break below 17.70 would bring into play the 10 DMA level at 17.53, which could set the scene for 17.00. On the upside, futures need to gain back above 18.00– a robust resistance level - in order to confirm upside momentum. The reaffirmation of support at that level could trigger gains towards the 40 DMA at 18.24; this could strengthen the trend on the upside in the long run. The hanging man formation points to an end of the uptrend, and we could see prices edge lower in the near term.

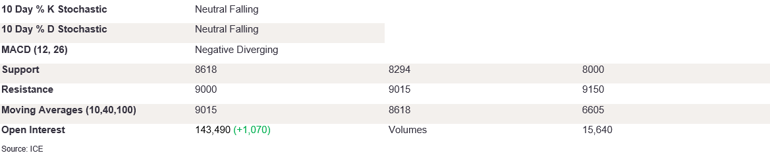

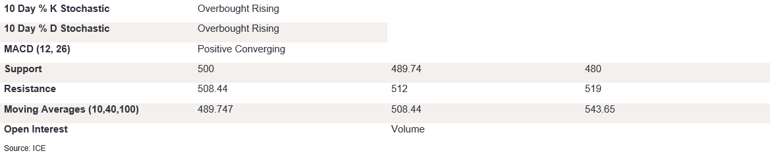

Ldn 2nd Month Sugar Futures

Ldn sugar futures held their nerve on Friday to close at 502.10. The stochastics are rising, but %K is seen tailing off on the downside in the overbought, which could suggest a change of momentum in the near term. The MACD diff is positive and converging, confirming waning buying pressures. On the upside, futures need to break above the robust resistance levels of 40 DMA at 508.44 and 512.60, respectively, to trigger the momentum. Prices would then need to take out 520 to confirm the upside trend continuation in the longer term. Conversely, appetite for prices below 500 could trigger a test of support of 493.80. A dragonfly doji candle shows rejection of lower prices, with support at 500 holding firmly. This level is key in gauging the market’s appetite for lower prices in the near term.

NY 2nd Month Coffee Futures

NY coffee futures started the day on the front foot on Friday but softened throughout the day back to the recent trend support, closing at 371.35. The stochastics are converging in the overbought territory, and the MACD diff is positive and diverging, suggesting we could see lower prices in the near term. A break below the trendline would bring into play the 350 level, which could set the scene for the 10 DMA at 346.64 – a break below could signal the end of the recent bullish momentum. On the upside, futures need to gain back above 375 in order to confirm upside momentum. The appetite above that level could trigger gains towards the 380 level; this could strengthen the trend in the long run on the upside. The hanging man formation points to an end of the uptrend, but the trendline remains robust as a support level and needs to be breached first to confirm the end of the recent bull trend.

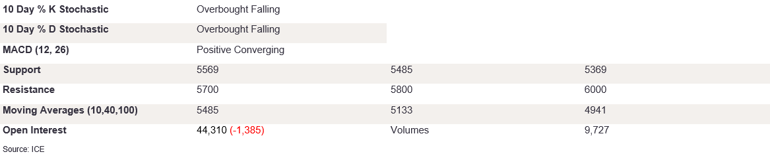

Ldn 2nd Month Coffee Futures

Ldn coffee futures held their nerve on Friday as intraday trading saw prices close at 5694. The %K/%D is falling out of the overbought. The MACD diff is positive and converging, suggesting further appetite for lower prices. To confirm this, futures need to break below the 5569 level to trigger the momentum. A break below this level towards the support of 10 DMA at 5485 would confirm the strong bearish momentum. Conversely, appetite for prices above 5700 could trigger a test of resistance of 5850. A long-legged doji candle shows indecision about higher prices above the regression’s upper channel levels. The indicators point to a fall in prices, but futures need to close below 10 DMA to confirm the momentum. In the meantime, prices are likely to strengthen following the longer-term upside trend.

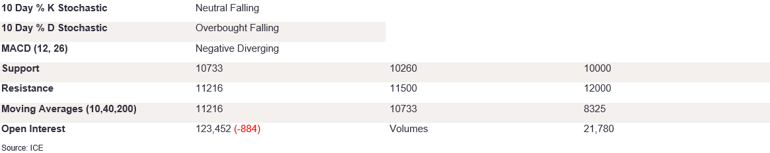

NY 2nd Month Cocoa Futures

NY cocoa futures softened on Friday but found support above 40 DMA. The market closed at 10855. The stochastics continue to soften, with %K/5D exiting the overbought territory, sending a strong sell signal. The MACD is negative and diverging, suggesting we could see lower prices in the near term through the support of 40 DMA at 10733. A break below this level would bring into play 10000, which could set the scene for lower prices in the longer term. On the upside, futures need to gain back above the 10 DMA at 11216 in order to confirm upside momentum. The reaffirmation of support there could trigger gains towards the level at 11500; this could strengthen the trend in the long run on the upside. A longer lower wick, where most of the trading took place in the upper ranges, points to a lack of appetite for lower prices; however, indicators point to further selling pressure in the near term. The 40 DMA support is key in gauging this appetite.

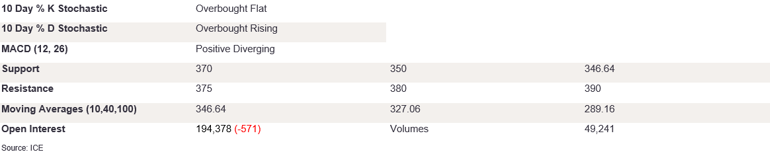

Ldn 2nd Month Cocoa Futures

Ldn cocoa futures weakened during the day on Friday, testing the support at 40 DMA. The market closed above it at 8694. The stochastics continue to soften, and the MACD diff is negative and diverging, suggesting we could see lower prices in the near term through 8294. A break below this level would bring into play the 8000. On the upside, futures need to strengthen back above 9000 in order to confirm upside momentum. The reaffirmation of support here could trigger gains towards the 10 DMA level at 9015. A longer lower wick, where most of the trading took place in the upper ranges, points to a lack of appetite for the downside. Futures need to take out the 40 DMA level to confirm the outlook for lower prices.